Governments cracking down against the likes of the Uber taxi-booking app, and other online tools, risk ultimately waging a losing battle against technologies empowering consumer choices.

Complaints about the performance of the taxi industry are legion, not only in Canberra but in other capital cities and large regional towns across Australia.

Government licensing regimes to operate a taxi have severely curtailed the supply of taxis for the paying public, characterised by astronomical licence fees running into the hundreds of thousands of dollars across the states and territories.

In a 2010 study of the ACT taxi industry it was estimated that the average fee for perpetual taxi licences leased from the government was more than $270,000.

Similar studies indicate the licence fee to operate a taxi in Sydney is over $350,000, and more than $400,000 in Melbourne.

The effects of inflated government licences upon the industry are significant, as owners pass hefty fares onto customers to help pay for the licence whereas many taxi drivers earn a pittance, leaving them on a precarious fare-by-fare existence.

The large licence fee has long created a significant barrier to entry into the taxi industry, contributing in turn to poor service availability (especially on weekends), unkempt vehicles, and some poorly trained drivers with little awareness of local conditions.

For the privileged owners of taxi licences, though, there is very little incentive to change this unsatisfactory situation, because they sit on a government-created goldmine whereby they lease out their licence rights to taxi operators for a princely sum.

Where there exists inflated fares and heavily constrained supply, eventually aspiring new entrants often seek to enter the industry and outperform the complacent incumbents, providing customers with a better, and cheaper, service in the process.

Enter the latest alternative, offered through smartphone community ride-sharing apps such as Uber, which connects people with drivers, not necessarily of the licensed taxi or hire-car varieties, for a cheaper price.

In response to complaints from the taxi industry, the NSW government declared uberX, the service run by non-licensed drivers, illegal under that state's Passenger Transport Act, whilst the Victorian government is issuing $1700 spot fines to Uber drivers.

While governments may have demonstrated a swift regulatory zeal to protect the taxi monopoly all of their own making, they are in many cases well behind the "sharing economy" trend behind apps and online applications that threaten heavily regulated industries.

In the US, various state and local jurisdictions have been attempting to protect the established hotel industry by stifling services provided by the Airbnb and Roomarama apps, which allow people to share their own apartment or home with a guest.

Another app has emerged, EatWith.com, which connects people wanting to eat cooked meals in other people's homes, an online trend which, on this occasion, has drawn the ire of food safety regulators in the US and elsewhere.

There is also the not insignificant matter of the open source, peer-to-peer Bitcoin global digital currency network, whose existence threatens the state's monopoly on money and has left regulators struggling to decide if Bitcoin is currency or property for taxation purposes.

In addition to these technological developments is the financing innovation known as "crowdfunding",which allows individuals and groups to advocate for causes that other people may be prepared to directly donate to online.

As demonstrated in the cases of successful crowdfunding efforts by the Climate Change Council, and organisers of the Queensland Literary Awards, it is entirely conceivable that a variety of functions financed by government can be readily transferred to civil society for subsequent crowdfunding.

The pitched battles between shared economy participants and, to a lesser extent, crowdfunders with governments, both here and abroad, provide a few object lessons about the role of government in the modern, innovative world.

The responsiveness of governments to the demands of established industry players to crimp emergent e-competition illustrates, in no uncertain terms, that the institutions of regulatory design and enforcement often promote the very interests of the regulated industries.

Contrary to the oft-expressed claims, regulatory objectives are not necessarily directed toward the generalised public interest of all members of the community, but against politically disconnected industry competitors and, through that, the general public in their capacities as consumers.

In addition to perverse incentive effects posed by the "regulatory capture" problem, the suppliers of technological innovations presented to the marketplace will, more often than not, be a few steps ahead of government efforts to stifle them on behalf of established corporate players.

And the romantic socialist idea that innovation can thrive under very prescriptive government regulations is little more than a pipe dream, since political actors lack the wherewithal to establish their own industries, and direct structural changes, for the benefit of consumers.

Rather than underwrite monopolies and cartels through maintaining discriminatory barriers to entry, shouldn't governments instead embrace the sharing economy which fosters service diversity, lowers transaction and other costs, and gives consumers what they want?

To do so would possibly necessitate a fundamental revision to the regulatory stance assumed by the public sector, to instead preside over abstract, general legislation that does not discriminate against the onset of new, and often unforeseeable, technological applications inducing winds of "creative destruction" through markets.

This "no fear, and no favour" approach to regulation would be in stark contrast to the flood of prescriptive, and in some cases even prohibitive, legislation informed by political "technopanics" in response to new waves of innovation which creatively and spontaneously emerge from economic processes.

There is also a plausible argument for the frequency of regulatory reviews to be escalated rapidly in acknowledgement of the rapid pace of technological change, such as that typified by Moore's Law, which states that computer processing speeds double every two years.

Sunsetting provisions could be affixed to government legislation, ensuring that statutes are reviewed every two years, or thereabouts, helping to ensure that public sector regulatory standards become more relevant against ever-changing economic and social circumstances affected by technological innovations.

Government might well pose as a great, even mortal, threat to elements of the peer-to-peer sharing economy, as it was for the likes of Napster and Silk Road before it.

However, for as long as people keep demanding cheaper and better quality products, the odds are in favour of the prospect that technology just might drive politics into the ditch of economic irrelevance.

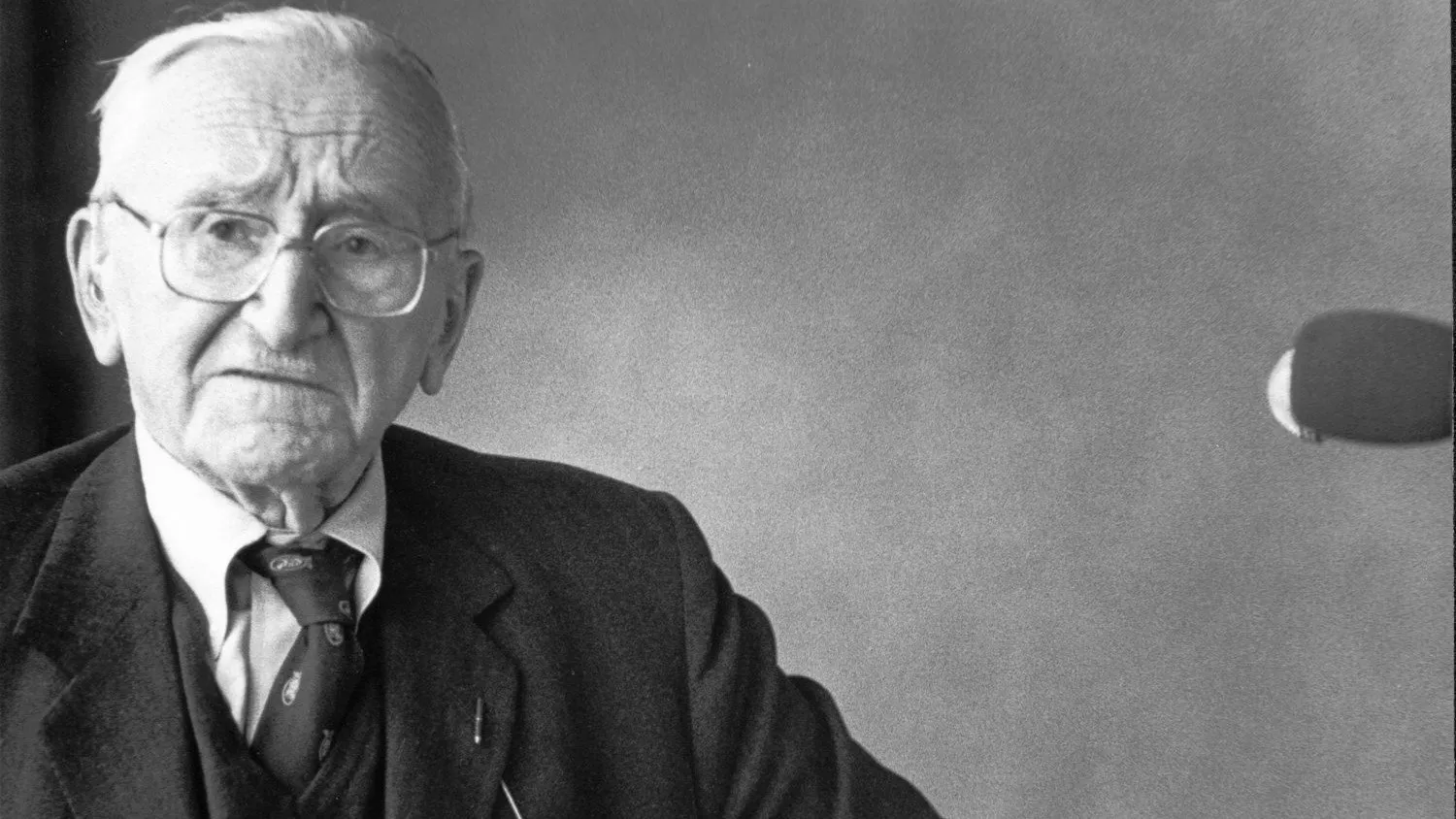

Friedrich August von Hayek was the greatest and one of the most under-rated classical liberal philosopher(s) of the twentieth century. He won the economics Nobel in 1974 ― yet it is fair to say that his contribution to economic theory is largely ignored by academic economists. Fellow economics laureate James Buchanan, for example, argues that Hayek's greatest contributions are his 1944 opus The Road to Serfdom and establishing the Mont Pelerin Society.

Friedrich August von Hayek was the greatest and one of the most under-rated classical liberal philosopher(s) of the twentieth century. He won the economics Nobel in 1974 ― yet it is fair to say that his contribution to economic theory is largely ignored by academic economists. Fellow economics laureate James Buchanan, for example, argues that Hayek's greatest contributions are his 1944 opus The Road to Serfdom and establishing the Mont Pelerin Society. In 2009 then prime minister Kevin Rudd had another go at Hayek; blaming him for the intellectual climate that had led to the Global Financial Crisis. The events of that year, in Rudd's mind, represented the triumph of Keynes over Hayek. But that was always bluff and bluster to cover over the problems within his own government. Indeed the very problems that Hayek would have predicted ― one man simply could not micromanage the entire government.

In 2009 then prime minister Kevin Rudd had another go at Hayek; blaming him for the intellectual climate that had led to the Global Financial Crisis. The events of that year, in Rudd's mind, represented the triumph of Keynes over Hayek. But that was always bluff and bluster to cover over the problems within his own government. Indeed the very problems that Hayek would have predicted ― one man simply could not micromanage the entire government. Habeas corpus is an ambitious topic to tackle. Its mythic status makes it all too easy for researchers to get romantic about this legendary writ. The eighteenth century jurist Sir William Blackstone described habeas corpus as "another Magna Carta". But, as Anthony Gregory demonstrates in The Power of Habeas corpus in America, reality is less straightforward.

Habeas corpus is an ambitious topic to tackle. Its mythic status makes it all too easy for researchers to get romantic about this legendary writ. The eighteenth century jurist Sir William Blackstone described habeas corpus as "another Magna Carta". But, as Anthony Gregory demonstrates in The Power of Habeas corpus in America, reality is less straightforward. The whirlwind analysis of centuries of legislation and case law halts to give a serious and ruthless assessment of habeas corpus in twenty-first century America. Gregory notes that US presidents have often been guilty of "habeas hypocrisy", yet President Barack Obama took it to another level. Decrying the abandonment of any pretence of judicial process in his War on Terror, President George W. Bush's program at Guantanamo rightly came under fierce fire by the then-Senator Obama. Yet once he was in office, not only did he renege on his promise to reinstate due process and habeas principles, Obama would "ratify and even amplify Bush's claims of executive power".

The whirlwind analysis of centuries of legislation and case law halts to give a serious and ruthless assessment of habeas corpus in twenty-first century America. Gregory notes that US presidents have often been guilty of "habeas hypocrisy", yet President Barack Obama took it to another level. Decrying the abandonment of any pretence of judicial process in his War on Terror, President George W. Bush's program at Guantanamo rightly came under fierce fire by the then-Senator Obama. Yet once he was in office, not only did he renege on his promise to reinstate due process and habeas principles, Obama would "ratify and even amplify Bush's claims of executive power".