Submission to the Senate's Rural And Regional Affairs and

Transport References Committee Inquiry into Deregulation

of the Australian Dairy Industry

SUMMARY

- The dairy industry has enjoyed some welcome prosperity over recent years following a slump in demand and low prices after the UK entered the European union (EU). Restricted access to international markets and heavily subsidised EU output displaces efficient production from other markets. The industry would be unwise to depend on an early improvement in overseas market access.

- The domestic market is experiencing only slow growth. For liquid milk, some increased growth might be expected with deregulation and the resultant lower prices/improved quality and product diversity.

- A viable industry must adopt the latest technology. World agriculture is on the cusp of a revolution with the explosion in availability of genetically modified plants. Genetically modified livestock may follow. Australian farmers have long proven to be open to new ways of improving their productivity. The more important challenge is to the present approval processes and, perhaps, labelling requirements. Rapid approval of new products is essential if Australian farmers are to have early access to technology -- particularly from North America.

- In the context of these changes, the Competition Principles Agreement is the catalyst to remove the domestic marketing support scheme (DMS). In a major sense, the removal of this scheme finally consummates the creation of the Australian Federation for the dairy industry! DMS requires the artificial separation of milk into two markets. The segmentation of the national market under the state marketing arrangements appears to be contrary to section 92 of the Constitution. Either the industry will deregulate at an early stage or a High Court challenge will require this. This is one reason why it is unlikely that other States could continue with their present regulatory measures if Victoria were to deregulate unilaterally.

- The removal of the Domestic Market Support scheme will bring an acceleration of the restructuring trends the industry has faced throughout its history. It will bring increased efficiency and improved consumer orientation of the industry. Although forecasts of the direction of structural change can never be precise, parts of Australia, particularly Gippsland in Victoria and Tasmania, are well suited to dairy production. These regions are likely to experience growth both in primary and secondary production. Other areas where dairying is dependent on protection afforded by the high prices of the domestic market support scheme are likely to see a contraction.

- Measures canvassed to facilitate the transition include a $1-1.5 billion fund. We believe such funding is neither necessary nor achievable. Our preferred position would be to have a three year phase-out of the existing dual price scheme. Compensation to those with fresh milk quotas might be contemplated but should be based on a discount of the price at which that quota is presently traded.

INTRODUCTION

The Industry's Characteristics

Milk production is critically dependent on natural inputs. Unlike most industries -- and even an increasing number of agricultural industries -- milk is best produced where natural climatic factors are propitious and land is relatively cheap. Rainfall and a temperate climate with a long growing season for grasses are crucial. Hence, parts of Australia, along with New Zealand, are ideally suited to the industry.

Traditionally, fresh milk has not been able to be stored for long periods and its production close to major markets has enjoyed natural barriers to competition. This is changing somewhat with the higher market acceptance and improved taste characteristics of UHT milk, but is likely to remain significant.

The industry's derivative products -- butter cheese, powdered milk etc. -- account for half its production and are readily preserved and traded.

The Industry's Output

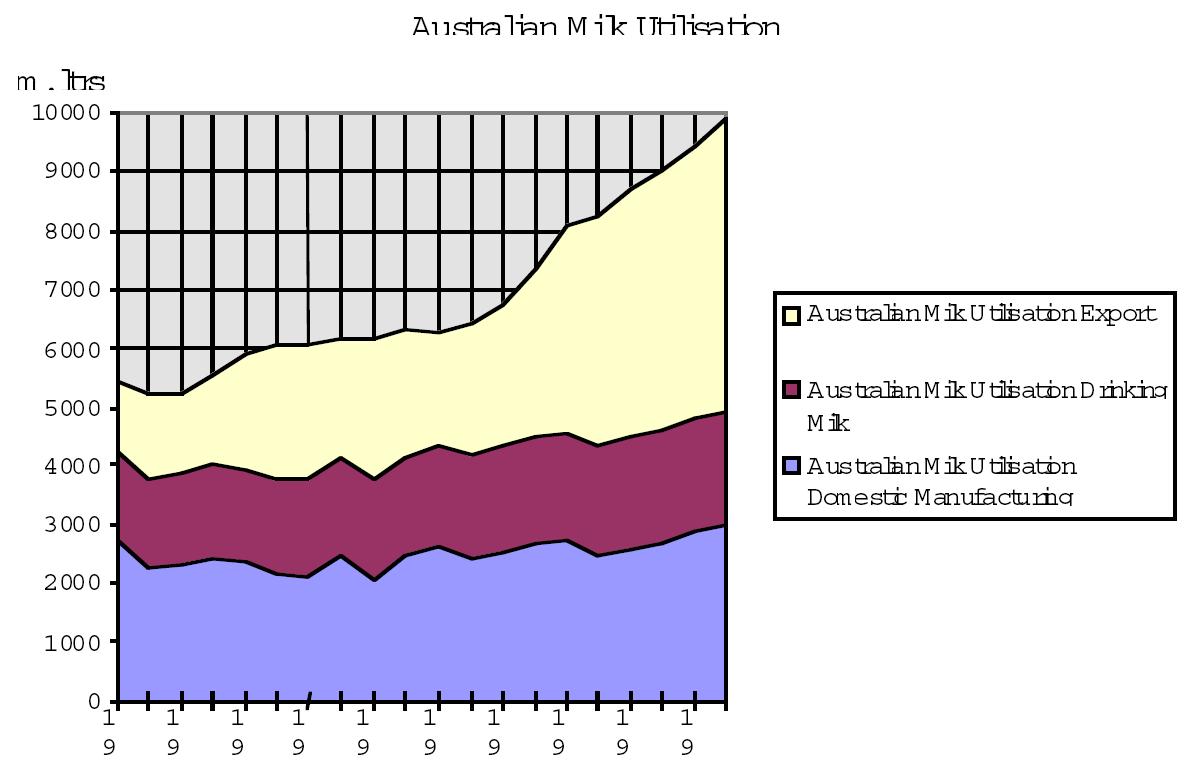

With the accession of the UK into the European Union, Australia lost its then most important export market. Annual milk production fell from over 7.5 billion litres in 1970 to less than 6 billion litres at the start of the 1980s. Since then production has steadily risen to over 9 billion litres. Of the Australian output, over half is exported with the remainder split evenly between drinking milk and manufactured products.

Australia, with some 12 per cent of the world export market, is a major supplier. Our market share is achieved notwithstanding the protectionist policies of other countries and the considerable export subsidies of the European Union. According to the Australian Dairy Corporation, production costs in Australia are less than two thirds of those in the EU and three quarters of those in the USA. New Zealand has a slightly lower cost structure than Australia.

Australian average costs tend to be boosted by production in areas not well suited to the industry. The parts of Australia ideally suited to milk production happen to be predominantly located in Victoria -- specifically the Gippsland region, which dominates the industry -- and Tasmania. Areas in South Australia and New South Wales also have conditions supportive of a vigorous industry.

Both in terms of herd size, averaging about 150 dairy cows per farm, and production per cow, output per farm has been increasing. Average herd size is considerably below the level at which economies of scale are exhausted. This is believed to approach a herd size of 2,000. Production per cow has increased by 40 per cent over the past twelve years. This is now reaching the maximum level readily achievable with existing strains but there will doubtless emerge prospects for increased output as genetic technology develops. These prospects are likely to become significant over the next few years, first in respect to grasses and perhaps subsequently with the animals themselves.

The number of dairy farms has halved to about 14,000 over the past 25 years, over 8,000 of which are in Victoria.

Victoria's share of national production is currently 62 per cent and has been increasing. This is a reflection of some liberalisation that has occurred and the trend away from fresh milk consumption. That latter trend may partly reflect Australia's changing population age profile but is also a reflection of health concerns regarding cholesterol. The industry's response has been to increase output of reduced fat milk and to find new fresh milk markets, especially flavoured milk. These product categories have grown from 10 per cent of fresh milk to almost half of the total during the past 12 years. Their growth is itself attributable in large part to the stimulus of increased competition in the industry.

The industry has also increased exports of liquid milk, largely in the form of UHT, though these still comprise only 3-4 per cent of domestic fresh milk sales.

Export production, which accounts for half of raw milk production, is valued at close to $2 billion. Exports are dominated by cheese, powdered milk and butter and are largely to Asia. Having hit a low point in the early 1980s, Australian exports have digested the loss of markets resulting from Britain's accession to the European Union and have been increasing rapidly over the past 15 years. The Asian crisis has not markedly reduced export growth, though prices have fallen.

The figure below illustrates the trends in production and utilisation.

Figure 1

Source: Australian Dairy Industry Corporation

Australian producers have long been hostage to the exorbitant subsidies offered to dairy farmers in other developed countries. In the case of the EU, they suffer the double whammy of negligible market access and EU subsidised exports capturing over 40 per cent of world trade and suppressing prices as a result.

Attempts to improve these market situations have been a major focus of Australian (and New Zealand) trade diplomacy for the past 30 years. This has brought no relief in the case of the EU, though Japan, as a result of shifting domestic tastes now constitutes a major market for Australian dairy products. While diplomatic initiatives are of considerable importance to allowing an efficient Australian industry to grow, it would be unsound, especially for a nation of Australia's small size, to attempt to offset protectionist effects by domestic subsidies. Our industry must live with the competitive environment that is in place, while diplomatic pressures are maintained to improve that environment.

REGULATORY ARRANGEMENTS

The Measures in Place

Across Australia, the dairy industry has been closely regulated over many years. Regulations have set prices at the farm gate, for cartage and in the retail outlets. The key aspect has been a dual price system with fresh milk receiving a high price and other milk usages being left to market forces. In States with a quota system, (NSW, Queensland and WA) the high price is dependent on owning quota (which can be traded). The other States pool the milk with farmers receiving the premium price for the fresh milk sales. These regulatory arrangements have been supplemented by formal and informal measures preventing inter-state sales.

The dual price system differs from state to state. The market milk price varies: it is 58 cents per litre in Queensland, 51 cents in NSW and 49 cents in Victoria. Milk for manufacturing purposes commands a price of about 24 cents per litre. This price differential is moderated somewhat by levies on fresh milk (about 1.9 cents per litre) and on manufactured milk for domestic consumption (around 3.7 cents per litre). The funds from these is directed to farmers for the milk they supply to manufacturers of dairy products.

Milk is, of course, a homogenous product and there is no difference between the product directed to the fresh milk market compared with that going to manufactured products (or going to the fresh milk market without a quota for the premium price). As a result of these factors, the producers receive markedly different prices for their output. Those farmers in States where fresh milk comprises a high share of output receive much higher prices.

Based on the NSW Dairy Corporation estimates, without allowing for the moderating influence of the levies, the average price received by Victorian farmers was 64 per cent of that received by those in NSW and Queensland (Tasmanian milk producers fared even worse, receiving only 59 per cent of the NSW/Queensland price). Figure 2 below illustrates the average prices received.

Figure 2

Decomposed into their two sub-parts, these prices are as shown in the table below:

| | Market

Milk | Manufactured

Milk |

| NSW/ACT | 50.9 | 25.1 |

| Vic | 48.1 | 22.7 |

| Qld | 58.9 | 24.0 |

| SA | 51.1 | 21.8 |

| WA | 53.3 | 25.6 |

| Tas | 54.9 | 20.4 |

This price disparity, as well as bringing about a considerable inefficient distortion in the industry nationally, represents a considerable burden on the Australian consumer. Milk producers, through the monopoly arrangements they have persuaded governments to underwrite, are engaged in price gouging of the Australian fresh milk consumer. Such actions almost certainly result in reduced consumption of milk products.

Within Victoria the Dairy Industry Act (1992) governs the industry. Sale of dairy products has been progressively liberalised. The key regulation remaining is the dual price system which was ostensibly intended to ensure sufficient supplies of market milk while offering "equitable" returns for farmers. The market for milk products is (and probably always was) sufficiently mature for no economic regulation to be necessary. As for the need for "equity" for producers, the search for the "just price" outside of the forces of demand and supply has a long and ignoble history.

General Government Regulatory Policy

The regulatory arrangements that allow the vast price dispersion of dairy products to occur are not compatible with those agreed to by Heads of Government in instituting the national competition policy reforms. Under the Competition Principles Agreement -- 11 April 1995, Governments agreed:

5.(1) The guiding principle is that legislation (including Acts, enactments, Ordinances or regulations) should not restrict competition unless it can be demonstrated that:

(a) the benefits of the restriction to the community as a whole outweigh the costs; and

(b) the objectives of the legislation can only be achieved by restricting competition.

These matters complement the regulation review procedures that are in place in most States. The Victorian Subordinate Legislation Act 1994 requires economic analysis and public scrutiny of all substantive regulations via a Regulatory Impact Statement (1). This applies to all existing regulations, which expire ten years after their enactment, and to new regulations. The Act draws attention to the possibility of regulatory failure and seeks to ensure that any regulation that is deemed necessary is the most efficient solution to the identified problem. Other States have similar provisions.

Incentives for the Government to Meet the Obligations

Governments have a general incentive to allow increased application of market forces simply because this allows greater wealth creation. The regulation review procedures that pre-dated the competition policy are testimony to the recognition of this.

Further disciplines to review competition within the deadlines set by the competition policy have been established by competition payments. These recognise that there is a national dividend from competition reform and that, at a governmental level, the Commonwealth rather than the States obtains the greater share of this because of the structure of Australia's tax system.

Hence, under the NCP Agreements, the Commonwealth agreed to make special payments to States and Territories that made satisfactory progress in implementing the national competition policy reforms. If a State or Territory does not take the required action within the specified time, its share of the payments will be withheld. The National Competition Council (NCC) program is to assess whether the conditions for payments to the States and Territories, have been met. The first formal assessment was made prior to 1 July 1997, and basically required only that at program be in place. The next assessments are to be made prior to 1 July 1999 and 1 July 2001 and will examine the outcomes of reforms in greater detail.

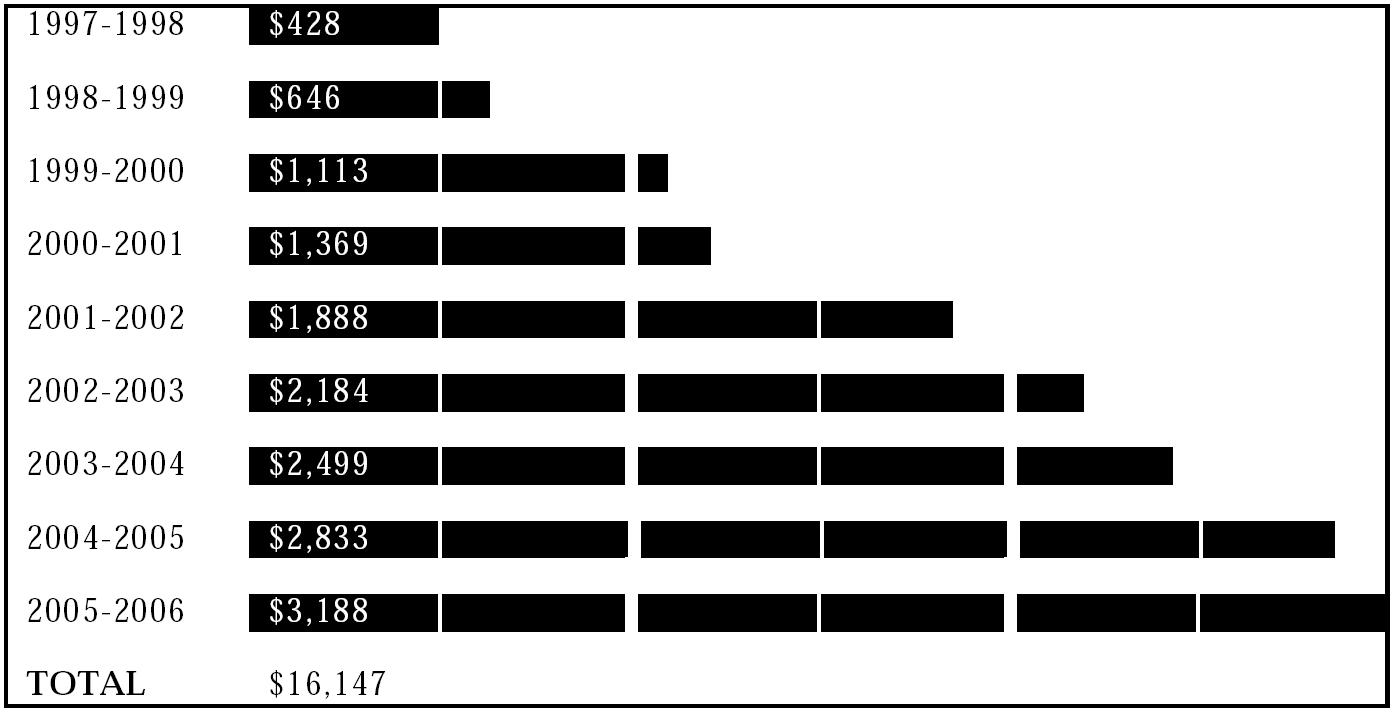

The money which has been allocated to these special payments is set out in Figure 3 below (estimated nominal $ million).

Figure 3: Competition Payments

Source: National Competition Council Brochure (October 1996)

The NCC has indicated the matters that can be taken into consideration in establishing interventions in the public interest. The criteria for doing so adopt a deregulatory approach but make clear the ultimate objective is not competition per se but using competition and deregulatory measures to enhance the community's living standards and employment opportunities.

Under Clause 1(3) of the CPA, several issues may be taken into account in determining what constitutes the "public interest". These cover a wide range of matters including:

- (d) government legislation and policies relating to ecologically sustainable development;

- (e) Social welfare and equity considerations including community service obligations;

- (f) government legislation and policies relating to matters such as occupational health and safety, industrial relations and access and equity;

- (g) economic and regional development including employment and investment growth;

- (h) the interests of consumers generally or of a class of consumers;

- (i) the competitiveness of Australian businesses; and

- (j) the efficient allocation of resources.

The NCC noted (2) that there were no weightings to these particular provisions. It argues that the onus is on those promoting an exemption of an arrangement to demonstrate that it will be a superior approach. In this respect, the NCC draws attention to the "net public benefit" test applied by the Australian Competition and Consumer Commission (ACCC). The ACCC approach is that, unless there are clear arguments to the contrary, competition is to be enhanced in order to meet the objectives of the Trade Practices Act (TPA) on which the competition reforms are largely predicated. The TPA's objective is to "enhance the welfare of Australians through the promotion of competition".

Other Pressures for Deregulation

As well as controlling price within their home States, the different State dairy industry acts allow the State dairy industry authorities to control exports out of their State jurisdictions and promotional activities.

These dairy industry regulations are clearly out of step with those required to generate efficiency and cause resources to be maintained in farming activities that would otherwise be non-viable, while preventing expansion in areas that are well suited to the activity. It would be exceedingly difficult to make a persuasive case for an exemption from general competition rules on any of the public interest grounds of the Competition Principles Agreement.

Indeed, the provisions that prevent the sale of milk between the different States is contrary to section 92 of the Constitution which requires that trade between the states shall be free. The de facto cartelisation of milk sales and production with the various State dairy boards, and the cross payments to producers in the more efficient States, has meant that no major interest group has seen a benefit in challenging the inter-State restrictions. With the deregulation that has already taken place, and the rise of major milk manufacturing businesses, this situation is unlikely to persist. A High Court challenge to restraints on trading between the States would be likely to succeed.

The major urban markets for fresh milk enjoy a natural distance related degree of protection. Although producers in the south east of the nation are lower cost, it would be difficult for them to displace fresh milk from the farms located close to the major metropolitan areas of Sydney, Brisbane or Gold Coast (or from Perth). However, that location protection is likely to come under increasing pressure as a result of a greater acceptance of UHT milk sourced either from inter-state or from New Zealand.

The competition policy is driven by a well-established belief in the potency of open markets and less government intervention in bringing efficiency. And it is only by having efficient production that industries can be sustained. Change is a major feature of economies which globalisation has accelerated. The change itself is due not to some ideological beliefs but in response to the shifting preferences of consumers and the need for producers to respond to them. Improved information and the competition of all goods for a share of the consumer dollar has meant that no industry can regard itself as stable. To survive, all industries must adapt to the market. Nations which turn their backs on market forces and technology trends will face lower living standards than their citizens would wish to have. And it is the individual operators within the industries, and those contemplating entry, not governments, which are the standard bearers of the change and efficiency enhancements. Protecting industries from change is a recipe for impoverishment.

These matters may assume greater importance in the future with genetic modifications of crops and, perhaps, livestock. While at present grasses are not believed to be a priority of genetic plant research, they will doubtless become so. Genetic modification is likely to allow a saving in inputs like fertiliser, weed control and water. In North America, genetically modified plant varieties are likely to dominate crops like soy, maize and canola by next year and will rapidly become important throughout the food chain.

At the present juncture, the Europeans have taken a cautious approach to these new varieties and are likely to find the competitiveness of their rural industries further deteriorating. It is vital that a nation like Australia, with primary production occupying a key place in our overall economy, rapidly embraces the new technologies being developed. Both here and overseas, genetically modified organisms are likely to bring a vast increase in production from existing farmland and to bring infra-marginal land into production. This will place downward pressure on prices and farm jurisdictions that reject the new technology will face severe difficulties.

The explosion of new strains based on genetic modifications will mean Australia must expedite approval processes. Although improvements in this area have been seen over recent years, Australian agriculture in dairy and elsewhere will suffer if our approval processes seek to duplicate those of overseas, especially in North America, on the spurious grounds that there are unique features of the soil and other aspects of Australia. The new technologies call for a reinvigoration of the policy of automatically adopting the approvals of selected overseas authorities.

IMPLICATIONS OF MARKET DEREGULATION

Different State Effects

The relative efficiency of milk production can be gauged by the share of premium priced milk on a state by state basis. This is illustrated in the Figure 4 below.

Figure 4

Market milk, according to the latest NSW Dairy Corporation estimates, accounts for only 7.6 per cent of Victorian production, and 10.2 per cent of Tasmanian and 26.7 per cent of South Australian. The other States' producers are heavily dependent on the regulated premium price.

Victorian farmers benefit in the short term from the regulated price, which doubles their revenues on 7.6 per cent of their production. They also benefit (by about $6,000 per farm) from cross-payment by inter-state farmers and manufacturers. Overall, ABARE estimates (3) that this will mean a reduction in incomes of about 4 per cent. Nonetheless, Victoria as a whole is in a strong position to benefit from deregulation. The immediate outcome will be both a reduction in price in fresh milk, and some increase in the price paid by manufacturers, which are lower than in the other two eastern States. The reduced price of fresh milk would be expected to boost demand. Moreover, Victorian milk would be expected to make some inroads into the State markets of NSW and Queensland, in the process reducing the price differential between market and manufacturing milk.

The State reviews in Queensland and NSW have acknowledged that their domestic industries would be forced to follow Victoria's lead in the event of deregulation. Although transport costs are an impediment to inter-state trade in fresh milk, some sales would be made by a Victorian industry fully unleashed to sell in markets where the price is double that available within the state. These pressures will force reductions in the regulated prices and undermine the two price system.

Hence, even if other States resisted deregulation (and forfeited competition policy payments as a result) the subsidies their dairy farmers obtain will be eroded. The size of their industries will contract and, especially in the manufactured products, production will migrate to Victoria and Tasmania. The cautious political announcements on deregulation in other States recognises that it may be better to grasp the nettle of deregulation once Victoria has done so and have the industry rationalise in an ordered manner rather than be gradually choked.

Deregulation will also bring milk inputs into line with their real price. The anomalies created by the dual price system are apparent in products like flavoured milk, where producers are obliged to source their inputs at fresh milk prices. Milk generally, and especially flavoured milk, competes in the general beverage market. Although these product lines have been growing strongly, with a 20 cent per litre reduction in their input prices resulting from deregulation, their growth would accelerate.

There has been considerable comment on the effects of different deregulatory moves on prices to the consumer. In Victoria, deregulation of retail margins did not bring a fall in consumer prices. In NSW, the retail deregulation in 1998 led to claims by the Minister that supermarkets had increase prices. While these claims have proved to be ill-informed, supermarket prices were relatively unchanged, retail margins in other outlets have tended to increase. A similar pattern occurred in New Zealand with deregulation of the fresh milk market in 1993.

Following deregulation, however, there was a vast increase in the variety of milk products being made available and a new enthusiasm for promoting milk by retailers able to obtain a commercial margin on their sales. In both cases, the previous regulation had led to a reduction in consumer choice and satisfaction, a reduction that is not easily measurable in standard price comparisons. Deregulation therefore brought increased benefits through allowing sellers profitably to meet consumer demands.

Impacts on Rural and Regional Communities

The trend in production has seen the industry migrate to the most efficient locations. At the present time Victoria is responsible for some 73 per cent of non-market milk dairy output and Tasmania a further 7 per cent. Deregulation is likely to see increased concentration of production areas. This may not mean the demise of production for other than the fresh milk market in areas other than Gippsland and northern Tasmania, the two areas of most obvious comparative advantage. Deregulation may well result in other areas assuming greater importance, in part because their favourable location close to major fresh milk markets allows them to obtain a higher average price for their product.

Economic models can be built incorporating different costs to offer insights into the future industry structure. Such models, however, have considerable limitations when used to project changes from a major modification in regulatory arrangements. Such marked modifications would include the significant change in marketing arrangements that deregulation will bring (or that technological change will force, albeit at a slower pace) makes industry location predictions difficult.

Although deregulation will mean considerable change to the industry, the positive aspects of this for rural Australia must be recognised. These include an increased rate of migration of primary and secondary production to areas where the activities can flourish. This is likely to mean expansion of employment in certain parts of Australia. Other parts will see a continuation -- possibly at an increased pace -- of the long process whereby dairy farms have been converted to wine, broadacre or other farming activities.

Compensation to the Industry

The industry is seeking restructuring assistance, one way or another underwritten by the Commonwealth Government. There is a case for such assistance where suppliers have quotas that enable them to earn premium returns. That case exists notwithstanding the fact that the quotas should not have been present in the first place. After all, quotas have created a property right and these rights should not lightly be abrogated. Estimates as to the sums involved vary between $1 billion and $1.5 billion.

That said, there are many reasons why no compensation should be offered. Not the least of these is that buying out quotas is a highly unusual procedure for the Commonwealth Treasury and one that they rightly resist. Such action sets considerable precedents. We have seen with analogous cases on the waterfront that the money dispersed to powerful bodies has had little effect in bringing about the necessary rationalisation. Moreover, tradable quotas are present only in three of the States and quota values have fallen markedly as the industry recognises the inevitability of change.

The normal process by which an industry is eased into a more deregulated structure is to offer a phase-in of the competitive gales. All manufacturing industries have faced a gradual reduction in tariff assistance over the past 25 years. Average tariffs on manufactures have been reduced from 28 per cent to about 3 per cent. The means by which the impact of these measures has been softened is through gradual reductions in assistance. The dairy industry would be best advised to explore such measures rather than seeking direct assistance.

ENDNOTES

1. See Regulation Impact Statement Handbook, Office of Regulation Reform, Department of State Development, Government of Victoria.

2. Considering the Public Interest under the National Competition Policy, National Competition Council, November 1996.

3. Topp V., Dairy Outlook to 2003-4, OUTLOOK 1999, ABARE, Canberra, April 1999.